You work too hard for too little. Your service business deserves to price for profit. This pricing guide shows you how to price a service business the right way.

Most service business owners guess at pricing. They charge what feels safe or copy competitors. Then they burn out working 60-hour weeks for poverty wages. This pricing service guide fixes that problem today.

I built a marketing agency that generated over $25M in client revenue. Forbes named me to their NEXT 1000 list. I learned pricing the hard way so you don’t have to. This service pricing guide gives you the exact pricing service system that works.

Table of Contents

- Why Your Service Business Pricing Decides Everything

- 7 Pricing Service Mistakes That Kill Service Business Profit

- How to Build Your Service Business Pricing Foundation

- 4 Pricing Service Models That Actually Work

- How to Calculate Service Business Prices Step by Step

- Service Pricing Psychology That Wins More Clients

- Your Service Business Pricing Action Plan

Why Your Service Business Pricing Decides Everything

Your service business pricing controls your entire business. Price too low and you work yourself to death. Price too high without the right positioning and nobody buys. This pricing guide helps you find the sweet spot.

Most service business owners think pricing is just math. They add up costs and add a margin. But service pricing is part math, part psychology, and part strategy. A good service pricing guide teaches all three parts.

When you price a service business correctly, three things happen. First, you attract better clients who value your work. Second, you make enough profit to invest in growth. Third, you stop resenting your business and start loving it again.

The Real Cost of Bad Service Business Pricing

Bad pricing costs you more than money. It costs you time with your family. It costs you sleep and health. It costs you the freedom you started your service business to gain.

I see service business owners working 70-hour weeks for $40,000 a year. They could make more flipping burgers with less stress. The problem isn’t their service quality. The problem is their service pricing strategy doesn’t support their life.

This pricing service guide fixes that problem. You’ll learn to price a service business for the life you want, not just to cover costs. That’s what separates a job from a real business.

What Makes Service Business Pricing Different

Service pricing differs from product pricing in key ways. You can’t inventory services or buy them in bulk. Every service delivery costs you time you’ll never get back. That makes time your most valuable pricing service input.

Service business pricing must also account for expertise. A massage therapist with 10 years of experience delivers more value than one with 10 months. Your pricing should reflect your service level and results, not just your costs.

The AI Profit Amplifier helps service business owners calculate their true pricing service capacity. It shows you exactly how many clients you can serve at different price points. This pricing guide walks you through the same process manually.

7 Pricing Service Mistakes That Kill Service Business Profit

Let’s talk about what kills service business profit. These pricing service mistakes cost owners hundreds of thousands in lost revenue. This pricing guide helps you avoid every one.

Mistake 1: Pricing Service Business Too Low to Win Clients

New service business owners panic about pricing. They think lower prices mean more clients. So they price their service business at bargain rates hoping volume will save them.

This pricing strategy fails for service businesses. You can’t scale service delivery like products. You have limited hours each week. When you price a service business too low, you need too many clients to survive. You burn out before you break even.

Research from the Small Business Administration shows that underpricing is a top reason service businesses fail. This pricing service guide teaches you to price for profit, not desperation.

Mistake 2: Copying Competitor Service Pricing Without Strategy

Many service business owners look at competitor pricing and match it. They think this pricing service approach keeps them competitive. But you don’t know your competitor’s costs, positioning, or business model.

Maybe your competitor has lower overhead. Maybe they target different clients. Maybe they’re going out of business because their service pricing doesn’t work. Copying their prices means you might copy their failure.

This pricing guide teaches you to set service business pricing based on your numbers. Your costs, your value, your goals. That’s how you build a profitable pricing service strategy.

Mistake 3: Forgetting Invisible Costs in Service Business Pricing

Service business owners often forget costs when they price a service business. They count their direct time but miss everything else. Administrative work, marketing, follow-up, training, software, insurance, taxes, equipment, and dozens of other costs.

This pricing service mistake means you think you’re profitable but you’re actually losing money. Every service delivery eats into your lifestyle because your pricing doesn’t cover real costs.

A complete service pricing guide must include all cost categories. This guide shows you a full cost worksheet later. For now, remember: if you didn’t budget for it, it will still cost you money.

Mistake 4: Setting Service Prices Based on Feelings Not Facts

I hear service business owners say “I don’t feel comfortable charging that much.” Feelings don’t pay bills. This pricing service mentality keeps owners broke and bitter.

Your service business pricing should reflect your value and costs, not your comfort level. If your pricing makes you uncomfortable, that’s probably because you undervalue yourself. This pricing guide helps you price a service business on data, not emotions.

Facts matter more than feelings in service pricing. Calculate your costs, research your market, and set prices that support your business. Your feelings will adjust when you see profit.

Mistake 5: Using Hourly Service Pricing When You Should Price by Value

Hourly pricing caps your service business income. You only have so many hours. When you price a service business by the hour, you trade time for money forever. That’s a job, not a business.

Value-based service pricing breaks this trap. You charge for results, not time. If you solve a problem that saves your client $50,000, you can charge $10,000 even if the service takes you three hours.

This pricing service guide covers multiple pricing models. Choose the one that fits your business stage and service type. But know that hourly pricing usually limits growth.

Mistake 6: Never Raising Service Business Prices

Your costs rise every year. Rent increases. Software subscriptions go up. Insurance premiums climb. Inflation eats your buying power. But many service business owners never raise their pricing.

This pricing service mistake slowly strangles your business. What worked five years ago doesn’t work today. This pricing guide includes a service pricing review schedule to keep your prices current.

Most service business clients expect price increases. They see prices rise everywhere else. Annual pricing adjustments of 3-10% keep your service business profitable without shocking clients.

Mistake 7: Having No Service Pricing Service Tiers or Options

Single-price service businesses leave money on the table. Some clients want basic service at a low price. Others want premium service and will pay for it. One service pricing option can’t serve both groups.

Tiered service pricing lets clients choose their level. It increases your average sale and serves more market segments. This pricing guide shows you how to create service business pricing tiers that work.

The finance strategies hub covers more pricing service psychology. But the key idea is choice. Give clients options and they’ll often pick the middle or high tier.

How to Build Your Service Business Pricing Foundation

Before you price a service business, you need foundation information. This pricing service section covers the data you must gather. Skip this step and your pricing will fail.

Calculate Your True Service Business Costs

Start with every cost your service business incurs. Fixed costs happen whether you serve one client or one hundred. Variable costs change with each service delivery. Your pricing must cover both.

Fixed costs include rent, insurance, software, utilities, marketing, administrative salaries, and equipment depreciation. List every fixed expense your service business pays monthly. Then multiply by 12 for annual fixed costs.

Variable costs include materials, contractor fees, transaction fees, shipping, and direct labor for each service. Calculate these per service delivery. Your service pricing must cover your variable cost per client plus a portion of your fixed costs.

Don’t forget hidden costs. Your time has value even if you don’t pay yourself yet. Budget for taxes, professional development, bad debt, and equipment replacement. Comprehensive service business pricing accounts for everything.

Determine Your Service Business Capacity

How many clients can you actually serve? This number controls your service pricing strategy. You can’t price a service business without knowing your maximum capacity.

Count your available service delivery hours per week. Subtract time for administration, marketing, and business operations. What’s left is your direct service capacity. Multiply by four for your monthly service business capacity.

Now factor in energy and quality. Maybe you can physically serve 40 clients per month. But can you maintain quality at that volume? Burnout ruins service businesses. Build buffer into your capacity calculations.

Your pricing guide should match capacity to goals. If you need $10,000 monthly profit and can serve 20 clients, your average service pricing must generate $500+ profit per client.

Research Your Service Business Market and Competitors

You can’t price a service business in a vacuum. You need market context. Research what clients pay for similar services. Look at competitor pricing, positioning, and service levels.

Don’t just copy competitor service pricing. Understand the range. Some service businesses charge premium prices with premium positioning. Others compete on price with high volume. Where do you want your service business to sit?

Talk to potential clients about pricing. Ask what they currently pay and what they value. This market research informs your service pricing strategy more than competitor stalking ever could.

According to pricing strategy research, service businesses that research their market charge 20-40% more than those who guess. This pricing guide gives you market research questions to ask.

Define Your Service Business Value Proposition

What results do you deliver for service business clients? Speed? Quality? Convenience? Expertise? Your value proposition justifies your service pricing to clients.

List every benefit your service provides. What problems do you solve? What outcomes do clients achieve? What would it cost clients to not use your service or to hire someone else?

Your service business pricing guide needs this value inventory. When clients question your prices, you’ll reference specific value. This pricing service technique moves conversations from cost to value.

The value proposition builder helps service business owners articulate their worth. Strong value propositions support higher service pricing without resistance.

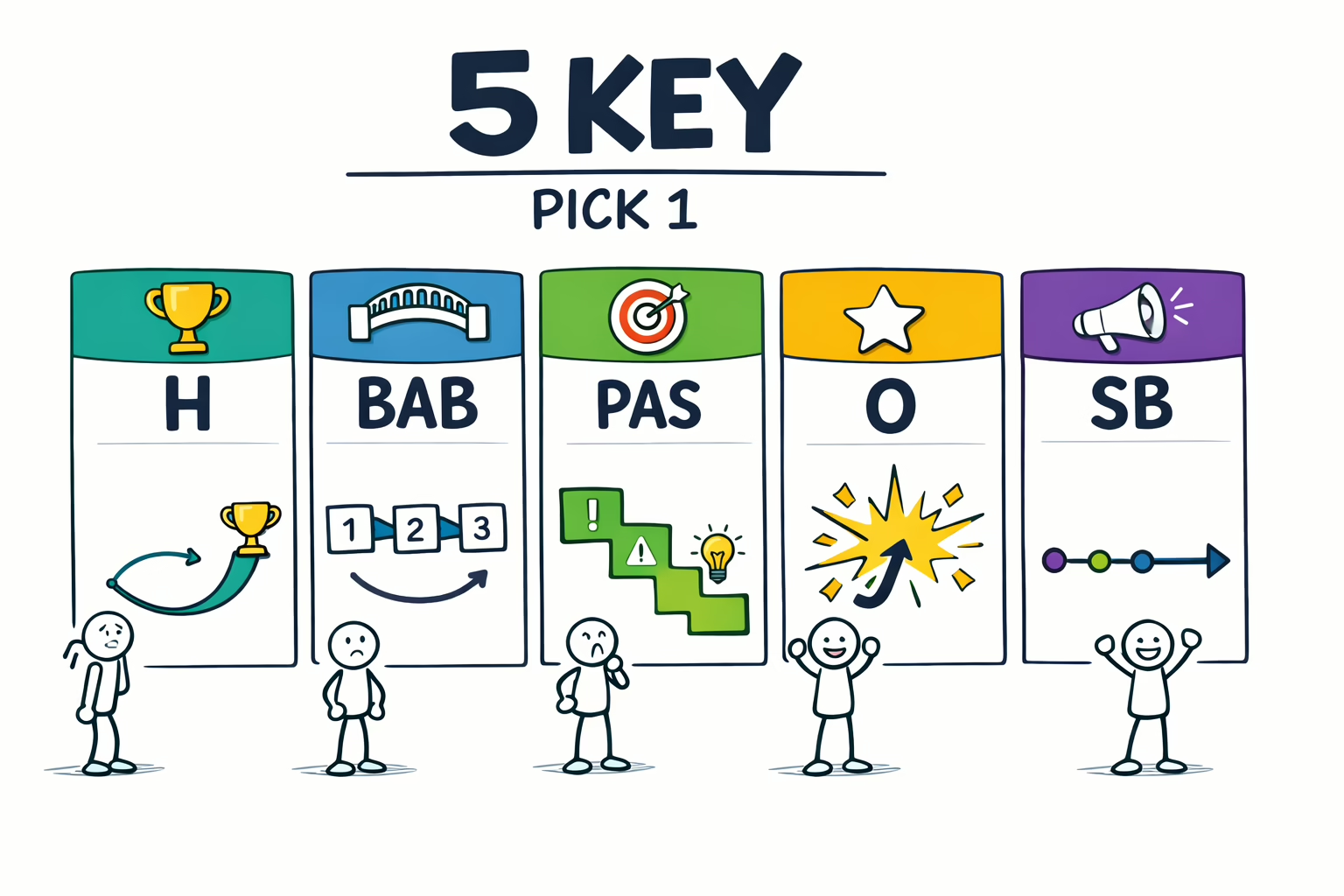

4 Pricing Service Models That Actually Work

This pricing guide section covers four proven service business pricing models. Each fits different service types and business stages. Choose the pricing service model that matches your goals.

Hourly Service Pricing Model

Hourly pricing charges clients for your time. You set an hourly rate and bill for every hour worked. Many new service businesses start with hourly service pricing because it feels simple and safe.

Calculate hourly service business pricing by adding all costs and dividing by billable hours. If your annual costs are $100,000 and you can bill 1,000 hours, you need $100 per hour to break even. Add profit margin for your final hourly rate.

Hourly service pricing works for consulting, coaching, bookkeeping, and other time-based services. But it caps your income at your hours. This pricing service model limits growth unless you hire a team.

Consider hourly pricing for your first year. Track your actual time per service. Then switch to a pricing model that rewards your efficiency instead of punishing it.

Project-Based Service Business Pricing

Project pricing charges one flat fee for a complete service delivery. Clients know the total cost upfront. You price a service business project based on value and scope, not just hours.

This service pricing model rewards efficiency. If you quote a website project at $5,000 and complete it in 10 hours instead of 20, you earn $500 per hour. The more efficient you become, the more profitable your service business.

Project service business pricing requires detailed scopes. You must define exactly what’s included. Otherwise scope creep kills your profit. This pricing guide includes a project scope template later.

Marketing agencies, designers, writers, and contractors often use project service pricing. It simplifies service business sales because clients see one clear price for one clear outcome.

Package Service Pricing Tiers

Package pricing offers multiple service levels at different prices. A basic package meets minimum needs. A premium package delivers full service. This pricing service model increases average sale value.

To price a service business with packages, start with your current service. That becomes your middle tier. Create a stripped-down version for price-sensitive clients as your basic tier. Add extras and VIP treatment for a premium tier.

Most clients choose the middle package when offered three options. But 20-30% upgrade to premium, increasing your average service business revenue per client. This pricing guide strategy is called the goldilocks effect.

Service businesses like cleaning, fitness, consulting, and marketing work well with package service pricing. You serve more market segments without confusing your core service business offering.

Value-Based Service Business Pricing

Value pricing charges based on the financial value you create for clients. If your service generates $100,000 in new revenue, you might charge $20,000. Your fee reflects the result, not your time or costs.

This service pricing model requires deep client discovery. You must quantify the value your service business delivers. What does the client gain? What does it save them? What would it cost them to not hire you?

To price a service business with value pricing, calculate the client’s potential gain. Charge 10-30% of that value depending on your risk and the client’s budget. This pricing service approach generates the highest fees.

Service business owners who implement value pricing often double or triple their income without working more hours. The offer builder tool helps you frame service business proposals around value instead of time.

How to Calculate Service Business Prices Step by Step

Now let’s do the math. This pricing service guide section shows you exactly how to calculate prices for your service business. Follow each step with your own numbers.

Step 1: List All Service Business Costs

Open a spreadsheet. List every fixed cost your service business pays monthly. Rent, software, insurance, marketing, phone, internet, professional fees, equipment leases. Total your fixed monthly costs.

Next list variable costs per service delivery. Materials, contractor fees, transaction costs, shipping. Calculate the variable cost for one typical service. This pricing guide needs accurate numbers.

Don’t forget to pay yourself. You work in your service business. Your time has value. Budget a reasonable salary for your role. This pricing service approach treats you like an employee, which you are.

Add taxes to your cost list. Federal, state, local, self-employment taxes typically consume 25-35% of service business profit. Most owners forget taxes when they price a service business. Then they owe shocking amounts in April.

Step 2: Calculate Required Service Business Revenue

Take your total annual costs. Add your desired profit. This sum is your required annual service business revenue. Divide by 12 for monthly revenue targets.

Example: $80,000 annual costs plus $50,000 desired profit equals $130,000 required revenue. That’s $10,833 monthly. Your service business pricing must generate this revenue to meet your goals.

Now divide monthly revenue by your service capacity. If you can serve 20 clients monthly, you need $542 per client to hit your goal. This pricing service calculation shows your minimum average sale.

If the math doesn’t work, you have three options. Raise your service pricing, increase capacity, or reduce costs. This pricing guide can’t change your costs, but it can help you price a service business for profit.

Step 3: Add Your Service Business Profit Margin

Your costs tell you your break-even price. But break-even isn’t enough. You need profit for growth, emergencies, and reward for your risk. Add 20-40% profit margin to your service business costs.

If your service costs you $100 to deliver, a 30% margin means you charge $143. That’s your minimum service pricing to stay healthy. Premium positioning might support 50-100% margins in some service businesses.

Compare your margin to industry standards. Research typical service business profit margins in your field. If you’re significantly below average, your pricing service strategy needs adjustment.

The Profit Amplifier tool calculates optimal service business pricing based on your costs, capacity, and goals. It shows you exactly what to charge to hit your profit targets.

Step 4: Test Service Business Pricing With Real Clients

You can’t fully validate service pricing without market testing. Take your calculated prices to real potential clients. Pitch your service at your new price and watch reactions.

If prospects don’t blink at your service business pricing, you might be too low. If everyone rejects you immediately, your pricing might be high for your current positioning. Most service businesses find the right pricing through testing.

Start with a pilot group. Offer your service business to 5-10 clients at your new pricing. Collect feedback. Adjust your pricing service presentation and value framing. Then roll out your new prices to your full market.

This pricing guide recommends testing for 30-90 days before committing. Track conversion rates, profit per service, and client feedback. Data beats guessing every time when you price a service business.

Step 5: Create Service Pricing Tiers and Options

Take your core service price and create three tiers. Basic, standard, premium. This pricing service structure serves more clients and increases average revenue per client.

Your basic tier strips down to essentials. Remove extras, speed, or premium features. Price it 30-40% below your standard service. This tier attracts budget clients to your service business.

Your premium tier adds value, convenience, speed, or VIP treatment. Price it 50-100% above standard. About 20% of clients will choose premium when you price a service business with good tiering.

Each service business pricing tier should feel like a clear upgrade. Clients should see why each level costs more. This pricing guide includes a tier builder worksheet you can download later.

Service Pricing Psychology That Wins More Clients

The right service business pricing is only half the battle. You must present prices in ways that clients accept. This pricing service guide section covers the psychology of pricing presentation.

Anchor Your Service Business Pricing to Value

Never lead with price when you present your service business. Lead with value. Describe outcomes, results, and transformations first. Then reveal pricing after clients understand what they receive.

Use anchoring to frame your service pricing. “Most service businesses spend $50,000 on this problem annually. Our service business pricing starts at $10,000 and solves it completely.” You just made $10,000 feel small by comparison.

This pricing guide technique works because humans judge value relatively. When you price a service business against alternatives, your pricing feels reasonable. When you present service pricing in isolation, it feels expensive.

According to pricing psychology research, anchoring increases perceived value by up to 40%. This pricing service technique costs nothing but dramatically improves conversion.

Use Charm Pricing Service Tactics Carefully

Charm pricing ends prices in 9 or 7 instead of round numbers. $997 instead of $1,000. Some service businesses swear by it. Others hate it. This pricing guide says test it for your market.

Charm service business pricing works better at lower price points. $49 versus $50 feels significantly cheaper. $9,997 versus $10,000 looks gimmicky. Use charm pricing below $500 in your service business.

For premium service pricing, round numbers signal quality. $5,000 feels more professional than $4,997 for high-end consulting. When you price a service business for premium clients, clean numbers work better.

Test both approaches in your service business. Run identical offers with different pricing service formats. Track which converts better. This pricing guide recommends data over opinion.

Frame Service Pricing by Month or Day Instead of Total

Large service business prices scare clients. Break them down into smaller increments. “$10,000 annually” becomes “only $833 monthly” or “less than $28 daily.” The same service pricing feels more accessible.

This pricing service tactic works especially well for subscription or ongoing services. “$200 per week” for lawn care feels better than “$10,400 yearly” even though it’s the same service business pricing.

When you price a service business for consumers, daily framing works best. “$5 per day” compares easily to coffee or lunch. For B2B service pricing, monthly framing matches how businesses budget.

Just be honest. Don’t hide the total service business pricing. State it clearly, then reframe it to show affordability. This pricing guide values transparency over tricks.

Offer Service Business Payment Plans

Payment plans remove price objections without discounting your service business. Clients who can’t pay $5,000 upfront might easily pay $500 monthly for 10 months. Same total service pricing, higher conversion rate.

When you price a service business with payment plans, you expand your market. More clients can afford you. But add a small fee for payment plans to cover risk and administrative costs.

Your service business pricing might be $5,000 paid in full or $550 monthly for 10 months. The installment option costs $500 more but makes your service accessible to more clients. This pricing service approach increases total sales.

Payment plans work best for higher-ticket service business offerings. Below $1,000, most clients pay in full anyway. Above $2,000, payment plans significantly increase conversion rates.

Compare Service Business Pricing to Alternative Costs

Help clients see what they’d pay for alternatives. If you charge $3,000 for service and hiring a full-time employee costs $60,000 yearly, suddenly your service business pricing looks incredible.

This pricing service technique shows value through comparison. You’re not expensive. You’re a bargain compared to other solutions to the same problem. This pricing guide calls it comparative framing.

When you price a service business, list 3-5 alternative solutions clients might consider. Show the cost, time, risk, or hassle of each alternative. Then show how your service pricing delivers better value.

The proposal builder includes comparison sections that help service business owners frame pricing against alternatives. This pricing service presentation closes more sales.

Your Service Business Pricing Action Plan

You now have a complete pricing guide for your service business. Time to implement. This pricing service section gives you the exact steps to take this week.

Implement Your New Service Business Pricing This Week

Don’t wait to update your service business pricing. Waiting costs you money every day you undercharge. Choose your pricing service model today. Do the math tomorrow. Test with three clients this week.

Start with new service business clients. You don’t need to raise prices on existing clients immediately. Just quote your new pricing for every new service opportunity. This pricing guide approach eases the transition.

When you price a service business for existing clients, give notice. “Starting next quarter, our service pricing will increase by 15%.” Most clients expect increases. The ones who leave probably weren’t profitable anyway.

Track results after you implement new service business pricing. Monitor conversion rates, average sale value, and profit per client. This pricing service data shows you what works. Adjust your pricing guide approach based on real results.

Review Service Pricing Every Quarter

Service business pricing isn’t set-it-and-forget-it. Your costs change. Your market changes. Your value changes. This pricing guide recommends quarterly pricing reviews to stay profitable.

Every three months, recalculate your service business costs. Check if your capacity changed. Research if market rates shifted. Adjust your pricing service strategy based on current data.

Small price increases compound over time. A 5% quarterly increase adds 21% annually. Your clients barely notice gradual service business pricing adjustments. But your profit grows dramatically.

When you price a service business dynamically, you stay competitive and profitable. Static pricing kills service businesses slowly. This pricing guide helps you build a pricing service review system.

Use AI Tools to Optimize Service Business Pricing

Modern AI tools can accelerate your service pricing decisions. The AI Profit Amplifier analyzes your service business numbers and recommends optimal pricing. It’s like having a CFO guide your pricing service strategy.

AI pricing tools calculate scenarios faster than spreadsheets. Want to know how a 20% price increase affects annual profit? The tool shows you instantly. This pricing guide recommends using technology to test options.

When you price a service business with AI support, you remove emotion and bias. The tool doesn’t care if you feel uncomfortable charging more. It just shows you the math. That clarity helps service business owners price confidently.

Other AI tools help you write pricing service proposals, create tiered packages, and present value. Technology makes professional pricing accessible to every service business owner.

Expert Insight from Kateryna Quinn, Forbes Next 1000:

“I increased my agency pricing by 40% in one quarter. I expected to lose half my clients. I lost two out of 30. The rest paid without complaint. I had been underpricing for years. Don’t make my mistake. Price your service business for the value you deliver, not your comfort level.”

Frequently Asked Questions

What is the best way to price a service business?

The best way to price a service business combines cost coverage with value delivery. Calculate all costs first. Add profit margin for growth. Then frame your service pricing around client value, not just your costs. Test pricing with real clients before committing.

How often should I review service business pricing?

Review service business pricing quarterly at minimum. Your costs change, your efficiency improves, and market rates shift. A quarterly pricing service review keeps you competitive and profitable. Annual increases of 5-10% maintain margin despite rising costs.

Should I use hourly or project pricing for my service business?

Project pricing usually generates higher profit than hourly rates for service businesses. Hourly pricing caps income at available hours. Project service pricing rewards efficiency and expertise. Use hourly pricing only when project scope is truly unpredictable.

How do I tell clients about service business pricing increases?

Give 30-60 days notice for service pricing increases. Explain value improvements or rising costs. Most clients expect increases. Frame the new service business pricing around continued value. Lock in current rates for clients who commit to longer contracts.

Can AI tools help me price a service business correctly?

Yes, AI pricing tools analyze your service business costs, capacity, and goals to recommend optimal pricing. They calculate scenarios instantly and remove emotional bias. The AI Profit Amplifier helps service business owners price confidently based on data, not guesses.

How to Price a Service Business: 10-Step Process

- List all fixed costs your service business pays monthly and annually.

- Calculate variable costs for each service delivery you complete.

- Determine your maximum service business capacity per month realistically.

- Add all costs plus desired salary and profit to find required revenue.

- Divide required revenue by capacity to find minimum service pricing per client.

- Research competitor pricing and market rates for similar service businesses.

- Choose a pricing service model that fits your business stage and goals.

- Create three service business pricing tiers with clear value differences between them.

- Test new pricing with 5-10 clients and collect detailed feedback on reactions.

- Review service business pricing quarterly and adjust based on costs and results.

What Does “Price a Service Business” Mean?

To price a service business means to set fees for your services that cover all costs, generate profit, reflect your value, and attract ideal clients. Service business pricing combines cost analysis, market research, value assessment, and strategic positioning. Unlike product pricing, service pricing must account for limited capacity, expertise levels, and intangible value delivery. Effective service business pricing balances what clients will pay with what you need to earn for a sustainable, profitable business.

Kateryna Quinn is an award-winning entrepreneur and founder of Uplify, an AI-powered platform helping small business owners scale profitably without burnout. Featured in Forbes (NEXT 1000) and NOCO Style Magazine (30 Under 30), she has transformed hundreds of service-based businesses through her data-driven approach combining business systems with behavior change science. Her immigrant background fuels her mission to democratize business success.